(Bloomberg) — The revenue-for-exports deal between the US government and two of the world’s biggest chipmakers opens a new front in a trading regime turned upside down by Donald Trump.

Most Read from Bloomberg

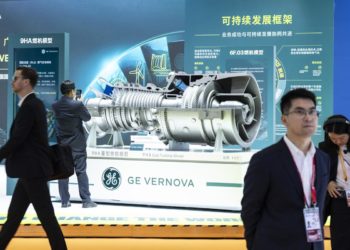

Nvidia Corp. and Advanced Micro Devices Inc. agreed to pay the US government 15% of revenue from some chip sales to China. The chips — Nvidia’s H20 AI accelerator and AMD’s MI308 chips — were earlier banned by the Trump administration and require export licenses to sell.

“To call this unusual or unprecedented would be a staggering understatement,” said Stephen Olson, a former US trade negotiator now with the Singapore-based ISEA — Yusof Ishak Institute. “What we are seeing is in effect the monetization of US trade policy in which US companies must pay the US government for permission to export. If that’s the case, we’ve entered into a new and dangerous world.”

The chip-payment arrangement may face legal challenges because it could be construed as an export tax, something that’s not allowed under the constitution, trade experts said. The proposal is the latest direct government intervention into business and finance since Trump returned to the Oval Office in January. As well as a chaotic tariff campaign and persistent criticism of a sitting Federal Reserve chairman, Trump has used his Truth Social platform for everything from calling on CEOs to resign to offering commentary on corporate advertising campaigns.

Trump’s transactional policy approach saw him approve the sale of United States Steel Corp. to Japan’s Nippon Steel Corp. in a $14.1 billion deal that included caveats such as agreeing to US national security rules and a “golden share” for the US government. Japan, South Korea and the European Union all pledged to invest billions in the US, helping secure tariff rates of 15%, while companies such as Apple Inc. have also skirted levies by promising to invest hundreds of billions of dollars.

The Nvidia and AMD revenue-sharing deals may now prompt the White House to target other industries and goods, according to Deborah Elms, head of trade policy at the Hinrich Foundation in Singapore.

“The sky is the limit,” she said. “You could come up with all sorts of company-specific, country-specific combinations that would say, ‘No one else can trade, but if you pay us directly, then you get the ability to trade.’”

Although Nvidia and AMD agreed to the terms, there are questions about the legality of the agreement, Elms said. The arrangement looks like an export tax, which is forbidden by the US Constitution.

The Trump administration is already in the midst of a lawsuit related to his use of the International Emergency Economic Powers Act to levy what he called “reciprocal” tariffs on the world. On Friday, Trump warned of a “GREAT DEPRESSION” if US courts ruled that his tariffs were illegal.

Chips are at the heart of the US-China battle to dominate industries of the future such as AI and automation. The Biden administration restricted the sale of advanced chips to China, prompting Nvidia to develop the H20, which skirted such restrictions. Trump administration officials tightened export controls in April by barring Nvidia from selling the chips without a permit.

Last month, however, the White House decided to allow Nvidia and AMD to resume sales of chips designed specifically for the Chinese market, which are several rungs below the most advanced artificial intelligence accelerators. Commerce Secretary Howard Lutnick said the administration wanted Chinese developers “addicted” to American technology.

China has grown increasingly hostile to the idea of Chinese firms deploying the H20, particularly after the US called for the chips to be installed with tracking technology to better enforce export controls. Yuyuantantian, a social media account affiliated with state-run China Central Television that regularly signals Beijing’s thinking about trade, on Sunday slammed the chip’s supposed security vulnerabilities and inefficiency.

Still, Chinese companies could use the H20s because domestic firms can’t produce enough AI chips to meet demand. That potentially provides an opportunity for Nvidia and AMD to sell more — and now for the US government to earn additional revenue as well.

Trump has yet to extend a 90-day trade truce between the US and China, which is set to expire on Aug. 12. Lutnick said last week that the detente was “likely” to continue as the world’s biggest economies continue to engage in talks ahead of a possible meeting between Trump and Chinese President Xi Jinping later this year.

“There’s clearly a shift by the administration to take a lighter national security stance as these negotiations are ongoing,” said Drew DeLong, lead in geopolitical dynamics practice at Kearney, a global strategy and management consulting firm.

China Draws Red Lines on US Chip Tracking With Nvidia Meeting

While the US has intervened before, including by taking stakes in private companies after the 2008 financial crisis, a similar deal like the one struck with Nvidia and AMD is hard to remember and — without proper oversight — could lead to a “crony capitalism state,” according to Scott Kennedy, senior adviser at the Center for Strategic and International Studies in Washington.

“It represents a huge shift in the way the American economy is supposed to operate,” Kennedy said. “It won’t make anyone happy except maybe the Chinese, who will get their chips and watch the US political system go through gyration and domestic tensions.”

(Updates to include reference to constitution in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

The post Trump Bid for Cut of Chip Revenue Risks ‘Dangerous World’ appeared first on Bloomberg.