(Bloomberg) — Gunjan Kedia wondered why her interviewer was asking for her feelings about penguins.

Most Read from Bloomberg

Invest in Gold

Powered by Money.com – Yahoo may earn commission from the links above.

She’d just arrived from New Delhi to Pittsburgh for business school and hadn’t yet learned the name of her new city’s beloved ice hockey team. It didn’t take long for her to get the lay of the land and begin rising through the finance industry. Decades later, she’s at the top of it.

The new head of U.S. Bancorp, parent of U.S. Bank, has a chance to reinvigorate the country’s fifth biggest commercial lender after it disappointed investors and analysts with lackluster returns. The bank didn’t keep pace in Wall Street’s all-important race to digitize banking and was on the back foot during a bout of industry turmoil as it sorted out a big deal it struck when the market had boomed. That left its stock at the bottom of a much-used industry index over the past decade. Now, with its assets approaching a threshold inviting stricter regulation, onlookers and rivals wonder if it should vault over it with a major merger.

The way she sees it, the bank is ready to thrive after its years of investments put it on stronger footing. “We’ve been telling that story over and over again,” Kedia, 54, said in an interview. “People don’t believe us very much, because you have to show the results.”

Change and even strife are woven into U.S. Bank’s history. Its predecessor opened in 1863 as Civil War cannons fired nearby, according to the firm, and an early branch fell victim to outlaw Butch Cassidy’s first bank robbery. More than a century later, an acquisition spree built the lender into one of the country’s biggest, and when the industry was threatened by the 2008 financial crisis it was seen as soundly managed.

Air Fresheners

Kedia traces the beginnings of her career to a pair of jeans she wanted in the ninth grade. To pay for them, with encouragement from her mom, she went door-to-door in New Delhi to sell air fresheners. After Kedia attended an all-girls school, she staged what she’s described as her own kind of rebellion to enroll in what was then the Delhi College of Engineering, where there weren’t many women. They welded, forged, blacksmithed and cut sheet metal, helping her get “very comfortable being the only one to be something,” she said in a career talk a few years ago.

She joined McKinsey in 1996, helping efforts to modernize technology for finance firms and making partner by 30. One longtime client, Mellon Financial Corp. boss Martin McGuinn, told her to call him first if she decided to leave. She did, and started at Mellon in 2004. It was a time of national consolidation, and Mellon soon merged with the Bank of New York to form what’s now called BNY.

“When you’re doing integration, it’s intense work,” she said. It entails competition and a fraught decision to pick “whose product survives.”

After a few years, she accepted a job offer from State Street Corp., one of the country’s biggest banks. Then, two weeks later, Lehman Brothers failed, changing her focus instantly.

“Overnight, the job became about risk management,” Kedia said.

In 2016, she joined U.S. Bank to oversee its wealth management and securities services business. In the crisis years earlier, the company’s tight risk management, limited exposure to subprime mortgages and high capital levels had given it an upper hand. But as the industry adjusted to new rules put in place to make it safer, the bank was late making investments in technology, which made it expensive to catch up.

Andy Cecere, her quiet and numbers-savvy predecessor, was promoted to CEO in 2017. As rivals got bigger — two merged in a mega-deal to form Truist Financial Corp. — he eyed a bigger presence on the West Coast. In September 2021, U.S. Bank announced it would acquire MUFG Union Bank’s core regional banking business from Mitsubishi UFJ Financial Group Inc.

But regulatory reviews took longer than expected, right as aggressive rate hikes caught much of the industry off guard, eroding the value of bonds in bank portfolios. MUFG Union Bank saw $2.1 billion of unrealized losses just before the deal closed in December 2022, which stung U.S. Bank.

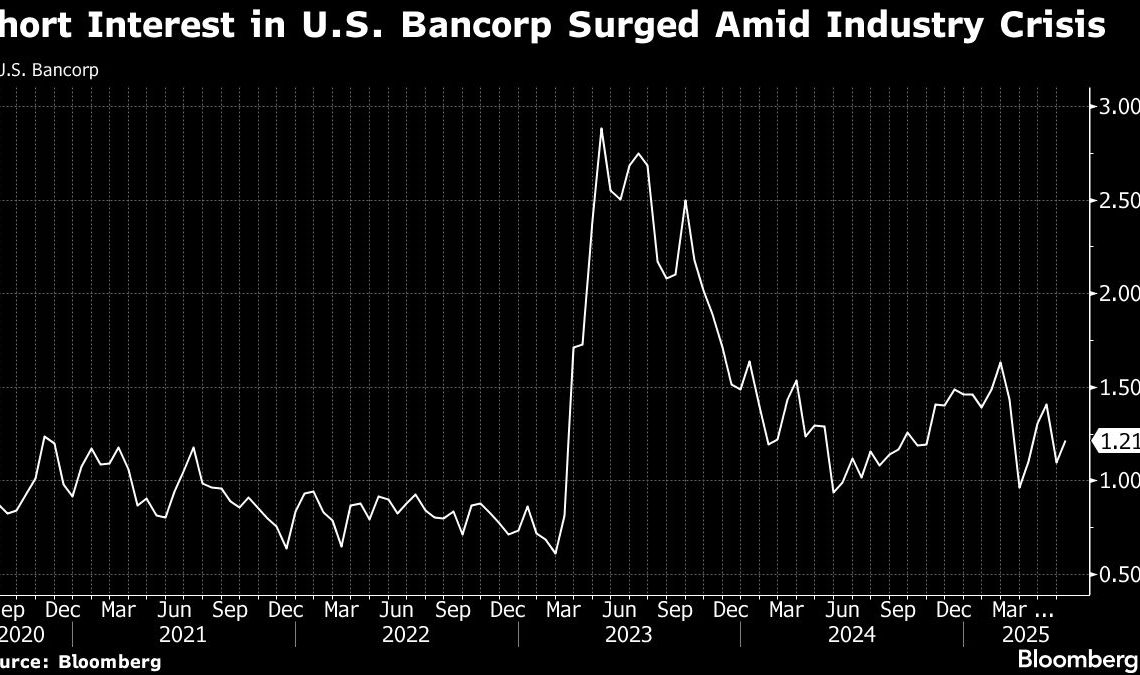

Within months, those rate hikes helped engulf regional banks in crisis. When regulators invited lenders including U.S. Bank to bid on beleaguered First Republic, capital was one reason it demurred. And as those government officials responded to the turmoil with talk of stricter capital rules, short sellers were circling. U.S. Bank helped drive some of them away by strengthening its balance sheet, including by selling underwater bonds and other assets.

Last year, when she was promoted to president, she and her husband celebrated with a private jet ride from Minneapolis to the Kentucky Derby, according to a post on his blog. The family has accumulated other markers of wealth, according to that blog, including a Ferrari.

Kedia became chief executive this April, making her the second woman to run one of the biggest US banks. Her most pressing goals — which include managing expenses, boosting results in the payments business and growing the bank without mergers or acquisitions — are more about improvement than disruption.

Back when she joined U.S. Bank, the businesses she oversaw accounted for about 10% of total revenues, Cecere has said, and five years later that portion was twice as high. Now she has to repeat that success on a wider stage. Part of the bank’s payments business, which processes money as it moves around behind the scenes, was seen for years as a drag on its resources. Kedia, who said past investments have positioned it to drive profits, hopes to make the bank into a stronger version of itself by the time it hits $700 billion of assets, the threshold that triggers stiffer regulation.

She’s less interested, for the time being, in buying a rival.

“I’ve been very clear: It’s not on the table,” Kedia said. “We take our medium-term goals very seriously, and M&A does not fit that promise to restore our valuation, to restore investor confidence.”

According to Art Collins, the bank’s former lead board director, she’ll have to think at some point about expanding consumer banking on the East Coast and in the South. “It’s highly likely that she would do that through an acquisition as opposed to trying to build it organically.”

Irish Whiskey

Even as the bank looks ahead, its executives have dealt with loss. Terry Dolan, a veteran colleague, died in a plane crash in March.

“When something positive happened, like when we closed an acquisition, Terry would come around the corner of my door, lean in, with his big grin and a bottle of Irish whiskey,” Cecere said in a memorial speech. “And he’d swirl it around and he’d say, ‘we did it.’”

When Kedia was working for State Street, she endeared herself to Jay Hooley, who was then its CEO. Now that she’s one too, he said, she’ll benefit from the kind of “straight talk about what’s going on” that she used to give him. “She’ll need that.”

–With assistance from Sridhar Natarajan.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

The post Banking’s Newest CEO Plots a Comeback for Most Unloved Stock appeared first on Bloomberg.