The House spent weeks in painstaking negotiations to be able to pass President Donald Trump’s “one big, beautiful bill” early Thursday morning. Now, Senate Republicans are preparing to put it through a buzzsaw.

Even after Speaker Mike Johnson urged senators to minimize their tweaks to the House’s product — and maximize the chances of squeezing it through the House a second time — Senate GOP leaders have made clear their members have their own ideas.

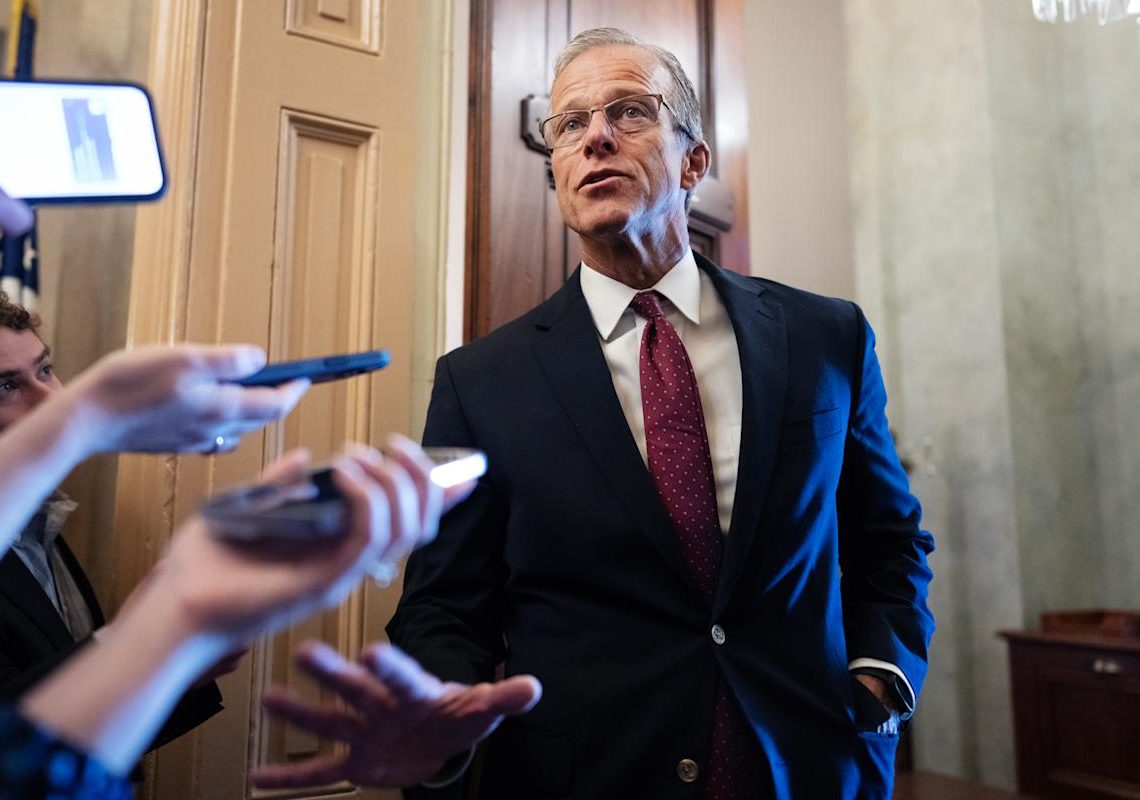

“They cobbled together a very delicate balance over there … but, you know, the Senate will have its imprint on it,” Senate Majority Leader John Thune said of House Republicans. “They’ve got to do what they can get 218 for, and we’ve got to do what we can get 51 for.”

Republicans in both chambers have been working quietly behind the scenes to try to move the House bill closer to the Senate’s druthers — including on defense funding — to avoid an ugly clash, and they believe there will be large areas of overlap. There have also been preliminary conversations to vet proposals for compliance with the Senate rules to avert a showdown with the parliamentarian.

But Senate Republicans are also making it clear they’re not happy with many policy choices their House counterparts made in order to get the bill through their chamber. With an informal July 4 deadline fast looming, here are seven features of the House bill some GOP senators want to change.

1. Weak spending cuts — Senate Republicans want to go higher than the House’s $1.5 trillion in spending reductions, instead eying a $2 trillion ceiling. Thune said in an interview he is aiming for his chamber to hit the higher end of that range and had been encouraging the House to go bigger in their own deficit reduction targets, too.

That’s because Thune, like the speaker, is facing a clutch of fiscal hawks who want a much higher spending cut target. Sen. Ron Johnson, a leader in this effort, is pushing for a return to pre-pandemic spending levels — a roughly $6 trillion cut. The Wisconsin Republican said in an interview he knows he won’t get that level of savings in the megabill but wants to tackle a chunk under the budget reconciliation process and then set up a bicameral commission to go “line by line” to find the rest.

Johnson also believes he has the votes to block a bill that doesn’t take deficit reduction seriously, pointing to Republican Sens. Mike Lee of Utah, Rick Scott of Florida and Rand Paul of Kentucky as senators sharing his concerns. But Rep. Thomas Massie (R-Ky.), one of two Republicans who opposed the House bill Thursday, said he has “no” confidence Paul and Johnson will get anywhere: “It’s not gonna get better over there.”

2. Medicaid financing changes — House Republicans avoided some of the most controversial changes to how the federal government treats states that have expanded Medicaid offerings under the Affordable Care Act. But even some of their more modest provisions could be jettisoned by GOP senators who fear political blowback from any policy that would appear to be pushing vulnerable Americans off their health insurance plans.

GOP Sens. Josh Hawley of Missouri, Lisa Murkowski of Alaska and Susan Collins of Maine have all warned they have red lines they will not cross on Medicaid and that they believe the House bill goes beyond “waste, fraud and abuse.” The alignment between Hawley, a staunch conservative, with moderates like Murkowski and Collins, underscores how skittishness over changes to the health safety-net program is resonating across the ideological spectrum.

Something Senate Republicans will need to wrestle with early on is the House’s freeze on the provider tax, as well as new co-payment requirements under Medicaid. “I think fiddling around with the provider tax is a real risk to rural hospitals,” Hawley said, referring to the proposed co-pay system as a “sick tax.”

But those Republicans will face off with some colleagues who support the House’s provider tax changes or want states to cover more of the costs for Medicaid expansion enrollees.

3. Business tax sunsets — House Republicans chose to restore certain business tax cuts for just four or five years as a way to keep costs down in their party-line package; Senate Republicans want to make those provisions permanent.

“They have cliffs and some shorter-term … time frames when it comes to some of the tax policies,” said Thune of House Republicans. “We believe that permanence is the way to create economic certainty.”

Senate Republicans are looking, in particular, at permanently extending tax incentives for research and development and write-offs for business assets known as “bonus depreciation.” But doing so would likely add hundreds of billions of dollars in red ink to the bill, which would make it harder to appease deficit hawks.

4. Accounting methods — GOP senators are planning to use a novel, controversial accounting tactic to completely zero out the cost of extending $3.8 trillion in expiring tax cuts. The tactic, known as current policy baseline, would go a long way in helping Senate Republicans make Trump’s tax cuts permanent. That’s because budget rules would otherwise require Republicans to offset much of the long-term deficit impact of their tax breaks.

Several House Republicans have indicated they’re opposed to the accounting method; Rep. David Schweikert of Arizona called it an “intellectual fraud.” Budget experts have also warned the move amounts to a “nuclear option” that would erode long-standing budget rules that allow only certain types of legislation to pass the Senate with a simple majority.

5. State cost-sharing for food aid — One of the most controversial provisions in the House bill is already sparking plenty of heartburn in the Senate: requiring states to cover a portion of federal food assistance costs for the first time.

The House bill would phase in a requirement that all states cover at least 5 percent of the cost for the Supplemental Nutrition Assistance Program, but some states could end up having to cover significantly more of that share if they have a high payment error rate. That would hit states represented by Republican senators particularly hard, including Alaska’s Murkowski and Dan Sullivan and South Carolina’s Lindsey Graham and Tim Scott.

Agriculture Chair John Boozman (R-Ark.) confirmed in an interview that Senate Republicans have concerns about this House proposal and that Republicans need to look at “how much of an unfunded mandate” it would create for states for “when our governors call us.”

6. Drastic cuts to clean-energy incentives — Senate Republicans have been warning for weeks that there is opposition to gutting the clean-energy tax credits created by the Democrats’ 2022 climate law. Instead, House Republicans opted to speed up the sunset dates for several credits to appease hard-liners railing against the “green new scam.”

Now Senate GOP leaders will need to navigate concerns within their own ranks from the other side of the equation: Republicans worried that cutting off the tax credits would undercut investments and lead to possible job losses in their states.

Four Republican senators recently sent a letter to leadership warning about these potential consequences, and others have since joined them in saying the House language will need to be reworked.

Sen. Thom Tillis (R-N.C.), one of the letter signers, added that the House’s offering would have a “chilling effect” on future investments and that Congress needs to “look at it through the lens of a businessperson.”

7. State-and-local-tax deduction cap — House Republicans have a red line in their bill: adherence to a carefully crafted agreement that would raise the state-and-local-tax deduction cap from $10,000 to $40,000, phased out for taxpayers making more than $500,000.

But in the Senate there are no GOP senators actively going to bat for the higher SALT deduction — and plenty who see no reason to do it at all. Ron Johnson, asked to preview his approach to SALT, didn’t mince words: “Eliminate it.”

“I certainly hope that we will modify that very generous SALT cap,” Sen. Kevin Cramer agreed, but when pressed whether he would be willing to go with the House’s number to protect the bill’s chances of passage through both chambers, the North Dakota Republican softened.

“The number that we care most about is 218,” he said, “depending on how many we can get to fall asleep.”

Lisa Kashinsky and Ben Leonard contributed to this report.

The post 7 things Senate Republicans hate about the House megabill appeared first on Politico.